Medicare Prescription Drug Plan Coverage in Stuart or Palm City

Expert guidance for Medicare Part D plans. Your Prescription drug plan in Stuart or Palm City, formulary reviews, and prescription benefits. Serving Martin County with personalized Medicare solutions for over 15 years.

Medicare Advantage vs Supplement in Stuart or Palm City

Understanding the differences between Medicare Advantage VS Medicare Supplement plans is crucial when choosing your coverage. Medicare Advantage plans often bundle hospital, medical, and prescription drug coverage into one plan, while Medicare Supplement plans help cover costs not paid by Original Medicare. We help you compare the options to find the plan that best suits your needs and budget in Stuart or Palm City, US

Prescription Drug Plans

The cost of prescription medications can add up quickly, and Original Medicare doesn't cover them. A Medicare Prescription Drug Plan (Part D) is essential for protecting your health and your budget. Plans and drug coverage can vary by location, so we help you compare all the Part D options available in Stuart or Palm City to ensure your medications are covered at the lowest possible cost.

How Drug Plans Work - Your Standalong Drug Plan

Part D plans are offered by private insurance companies and are designed to work alongside Original Medicare. You pay a separate monthly premium for the plan, which then helps cover the costs of your medications. Each plan has its own list of covered drugs, called a formulary.

Helps Cover the Cost of Your Prescriptions

Works Together with Original Medicare

Can Be Paired with a Medigap Plan

Helps Protect You From High Drug Costs

Avoids Late Enrollment Penalties

Choosing the Right Plan - Your Medication, Your Plan

The best plan for you is the one that covers your specific medications. Two people can be on the same plan and have very different costs. We use special tools to enter your exact prescription list and compare every plan to find the one that offers you the lowest total out-of-pocket cost for the year.

Checking the Plan's Drug List (Formulary)

Using In-Network or Preferred Pharmacies

Understanding Tiers, Co-pays & Deductibles

Finding Plans with the Lowest Overall Cost

Reviewing Your Plan Annually is Crucial

Local Broker Assistance - Your Unbiased Local Guide

Instead of working for one insurance company, we work for you. As local brokers, our job is to understand your needs and compare all the top plans to find your best match.

Licensed & Trained Local Experts

We Compare All The Top Carriers

Personalized, Honest Advice

Support That Puts You First

Our Guidance is Always Free

Year-Round Support - A Partner in Your Health

Our commitment doesn't end when you enroll. We're here to help you all year long, whether you have questions about your coverage or need help with a plan change.

Annual Plan Reviews

Help with Claims & Appeals

Answering Your Questions

A Health Partner You Can Trust

Services

We Specialize in:

STILL NOT SURE?

Frequently Asked Questions

1. What is Medicare Part D?

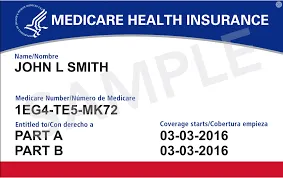

Medicare Part D is the part of Medicare that provides prescription drug coverage. Because Original Medicare (Parts A and B) does not cover most prescription drugs, you need to enroll in a Part D plan to get help with the cost of your medications. These plans are offered by private insurance companies approved by Medicare.

2. How do I find the best prescription plan for my specific medications?

The "best" plan is not the one with the lowest monthly premium, but the one that gives you the lowest total out-of-pocket cost for the year. Each plan has its own list of covered drugs, called a formulary. The only way to know for sure is to have a professional run an analysis of your exact drug list against all the plans available in Stuart or Palm City to see which one covers your medications at the lowest cost.

3. Can I use any pharmacy with my Part D plan?

Most Part D plans have a network of pharmacies they partner with. While you can often use out-of-network pharmacies, your costs will be much higher. To save the most money, you should use an "in-network" pharmacy. Many plans also have "preferred" in-network pharmacies where your co-pays will be even lower. We can help you check if your favorite local pharmacy is preferred by the best plan for you.

4. Why do my drug costs change from year to year, even on the same plan?

This is a very common experience, and it's why an annual plan review is so important. Each year, insurance companies can change their plan's monthly premium, annual deductible, and most importantly, their list of covered drugs (the formulary). A medication that was in a low-cost tier last year might be moved to a higher-cost tier this year, or a preferred pharmacy could be removed from the network. The only way to ensure you're still on the best plan is to compare it with the new options available each fall.

Still Have Questions?

Our Medicare specialists in Stuart or Palm City are here to help with personalized guidance

LICENSED AND CERTIFIED

Florida Licensed Medicare Specialists

Community Focused

Dedicated to Stuart or Palm City seniors

5-Star Reviews

Trusted by local families

Martin

Serving all local communities

24 Hours by Appointment Only

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options

By providing your name and contact information you are consenting to receive calls, text messages and/or emails from a licensed sales agent about Medicare Plans at the number provided, and you agree such calls and/or text messages may use an auto-dialer or robocall, even if you are on a government do-not- call registry. This agreement is not a condition of enrollment. This is a solicitation of insurance. Your response may generate communication from a licensed insurance agent.