Group Health Insurance in Stuart or Palm City

Providing comprehensive health coverage for your employees is crucial for their well-being and job satisfaction. We offer tailored group health insurance plans that provide excellent coverage for businesses of all sizes in Martin. Our plans are designed to meet the diverse needs of your workforce, ensuring they have access to quality healthcare benefits. Call to learn more about our group health insurance options and how we can support your employees' health. Stuart or Palm City, Martin

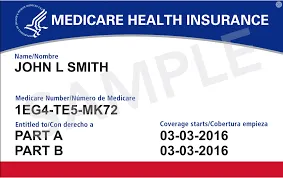

Medicare Advantage vs Supplement in Stuart or Palm City

Understanding the differences between Medicare Advantage VS Medicare Supplement plans is crucial when choosing your coverage. Medicare Advantage plans often bundle hospital, medical, and prescription drug coverage into one plan, while Medicare Supplement plans help cover costs not paid by Original Medicare. We help you compare the options to find the plan that best suits your needs and budget in Stuart or Palm City, US

Group Health Insurance

Offering quality health insurance is one of the best ways to attract and retain great employees. But navigating the world of group plans can be complex and time-consuming. We specialize in helping small businesses in Stuart or Palm City find affordable, high-quality health insurance plans that fit their budget and take care of their team.

A Smart Investment in Your Team

In today's competitive job market, a strong benefits package is essential. Offering group health insurance shows your employees you value their health and well-being, making your company a more attractive place to work.

Gain an Edge in Attracting Skilled Employees

Increase Employee Loyalty and Reduce Turnover

Promote a Healthy, Productive Workforce

Potential Tax Advantages for Your Business

Boost Team Morale and Job Satisfaction

Plans That Fit Your Business & Budget

You don't have to be a large corporation to offer great benefits. We have access to a wide range of plans from all the top carriers and can help you find a solution that meets your team's needs without breaking your budget. We do all the shopping and comparing for you.

Comparing All Top-Rated Insurance Carriers

Clear Explanations of Plan Types (PPO, HMO, etc.)

Finding Plans that Meet Your Company's Budget

We Manage the Application & Enrollment Process

Simplified Plan Administration

Expert Guidance for Your Business

Instead of working for one insurance company, we work as an extension of your team. Our job is to understand your business goals and find a health plan that benefits both your company and your employees, saving you time and money.

Licensed & Trained Local Experts

Strategic Advice for Your Business

We Handle the Carrier Negotiations

Dedicated Support for Your Admin Team

Our Consulting is Always Complimentary

Ongoing Year-Round Support

Our partnership doesn't end once a plan is in place. We provide continuous support to you and your employees, assisting with claims issues, onboarding new hires, and strategically managing your annual plan renewal.

Annual Renewal & Strategy Review

Assistance with Employee Claims & Billing

Onboarding New Hires to the Health Plan

Answering Employee Benefit Questions

A Trusted Benefits Partner for Your Business

Services

We Specialize in:

STILL NOT SURE?

Frequently Asked Questions

1. Does my small business qualify for group health insurance?

Yes, most likely. In most states, you only need a minimum of two employees to qualify for a group health plan, and one of them can be the business owner. The requirements are designed to be accessible even for very small businesses. We can quickly confirm the specific eligibility rules for your company here in Stuart or Palm City and help you get started.

2. As the employer, do I have to pay for the entire premium?

No, you do not. The most common arrangement is for the employer to cover at least 50% of the monthly premium for their employees. You can choose to contribute a higher percentage or also contribute towards the premiums for employees' families, but it's typically not required. We can help you structure a contribution strategy that fits your budget and business goals.

3. What are the benefits for my business if I offer health insurance?

Offering group health insurance is one of the most powerful investments you can make in your business. It gives you a significant competitive edge in attracting and retaining talented employees, reduces turnover, and leads to a healthier, more productive workforce. Plus, there are often significant tax advantages for the premiums your business pays.

4. Why should I use a broker instead of just calling an insurance company?

That's a great question. An insurance company can only sell you its own products. As independent brokers, we work for you, not for any single insurance carrier. We shop the entire market to find the best plan at the best price for your business. Our expert guidance and ongoing support—from enrollment to annual renewals—are provided at no cost to you, saving you an immense amount of time and potential frustration.

Still Have Questions?

Our Medicare specialists in Stuart or Palm City are here to help with personalized guidance

LICENSED AND CERTIFIED

Florida Licensed Medicare Specialists

Community Focused

Dedicated to Stuart or Palm City seniors

5-Star Reviews

Trusted by local families

Martin

Serving all local communities

24 Hours by Appointment Only

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options

By providing your name and contact information you are consenting to receive calls, text messages and/or emails from a licensed sales agent about Medicare Plans at the number provided, and you agree such calls and/or text messages may use an auto-dialer or robocall, even if you are on a government do-not- call registry. This agreement is not a condition of enrollment. This is a solicitation of insurance. Your response may generate communication from a licensed insurance agent.