Health Market Insurance in Stuart or Palm City

Navigating the healthcare marketplace can be complex, but we're here to help you find the right coverage for your needs. We specialize in assisting individuals and families in understanding and selecting the best healthcare plans available in Stuart or Palm City through the marketplace, often referred to as Obamacare. We can guide you through the options, explain the benefits, and help you find a plan that fits your budget and healthcare needs. Call today for personalized assistance in securing your marketplace healthcare coverage in Stuart or Palm City, Martin

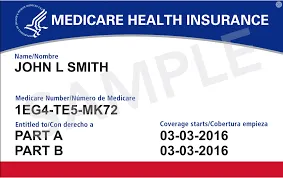

Medicare Advantage vs Supplement in Stuart or Palm City

Understanding the differences between Medicare Advantage VS Medicare Supplement plans is crucial when choosing your coverage. Medicare Advantage plans often bundle hospital, medical, and prescription drug coverage into one plan, while Medicare Supplement plans help cover costs not paid by Original Medicare. We help you compare the options to find the plan that best suits your needs and budget in Stuart or Palm City, US

Health Market Insurance

If you don't have health insurance through a job, Marketplace plans (also known as Obamacare or ACA) are designed to provide affordable, quality coverage. The key benefit is financial assistance that can lower your monthly premium. We help individuals and families in Stuart or Palm City navigate the options and enroll in a plan, all at no cost to you.

Quality Coverage You Can Count On

All plans offered on the Health Insurance Marketplace must cover a set of essential health benefits, including doctor visits, hospital care, and prescriptions. Crucially, you cannot be denied coverage for having a pre-existing condition.

Guaranteed Coverage for Pre-existing Conditions

Covers Doctor Visits & Hospital Stays

Includes Prescription Drug Benefits

Free Preventative Care & Wellness Visits

Multiple Plan Levels to Fit Your Budget

Financial Help is Available - Lower Premium

The single most important feature of the Marketplace is financial help. Based on your income and family size, you may qualify for a Premium Tax Credit (or subsidy) that directly reduces the amount you pay for your health insurance each month.

Most People Qualify for Financial Assistance

We Can Instantly Check if You're Eligible for Savings

Some May Qualify for Plans with a $0 Premium

Avoid the Confusion of the Government Website

Let Us Make the Enrollment Process Simple

Local Broker Assistance - Your Unbiased Local Guide

Instead of working for one insurance company, we work for you. As local brokers, our job is to understand your needs and compare all the top plans to find your best match.

Licensed & Trained Local Experts

We Compare All The Top Carriers

Personalized, Honest Advice

Support That Puts You First

Our Guidance is Always Free

Year-Round Support - A Partner in Your Health

Our commitment doesn't end when you enroll. We're here to help you all year long, whether you have questions about your coverage or need help with a plan change.

Annual Plan Reviews

Help with Claims & Appeals

Answering Your Questions

A Health Partner You Can Trust

Services

We Specialize in:

STILL NOT SURE?

Frequently Asked Questions

1. Who is Marketplace health insurance for?

Marketplace insurance is designed for individuals and families who are under the age of 65 and do not have access to affordable health coverage through an employer, Medicare, or Medicaid. It's a perfect solution for the self-employed, small business owners, early retirees, and anyone working a job that doesn't offer health benefits.

2. How do I know if I can get help paying for my plan?

The most important feature of the Marketplace is financial assistance, also known as a premium tax credit or subsidy. Your eligibility is based on your estimated household income for the year and your family size. The majority of people who enroll in a plan qualify for some level of financial help, which can significantly lower their monthly premium. We can help you check your eligibility in just a few minutes.

3. When can I enroll in a Marketplace plan?

The main time to enroll is during the Open Enrollment Period, which happens every year in the fall. However, if you experience a qualifying life event during the year—like losing your job-based health coverage, getting married, or having a baby—you may be eligible for a Special Enrollment Period that allows you to sign up for a plan mid-year.

4. Why use a broker when I can just go to HealthCare.gov?

While you can use the government website, it can often be confusing and overwhelming. As certified Marketplace brokers, our services are 100% free to you. We simplify the entire process, help you accurately estimate your income to maximize your subsidy, and compare all the plan options available in Stuart or Palm City to find the one that truly fits your needs and budget. Plus, you get our personal support all year long if you ever have an issue.

Still Have Questions?

Our Medicare specialists in Stuart or Palm City are here to help with personalized guidance

LICENSED AND CERTIFIED

Florida Licensed Medicare Specialists

Community Focused

Dedicated to Stuart or Palm City seniors

5-Star Reviews

Trusted by local families

Martin

Serving all local communities

24 Hours by Appointment Only

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options

By providing your name and contact information you are consenting to receive calls, text messages and/or emails from a licensed sales agent about Medicare Plans at the number provided, and you agree such calls and/or text messages may use an auto-dialer or robocall, even if you are on a government do-not- call registry. This agreement is not a condition of enrollment. This is a solicitation of insurance. Your response may generate communication from a licensed insurance agent.