Life Insurance in Stuart or Palm City

Planning for the future is essential, and we're here to help you protect your loved ones with reliable life insurance options. We offer a variety of life insurance policies designed to provide financial security for family in the event of the unexpected. We can help you understand the different types of life insurance, assess your needs, and choose a policy that provides the right level of coverage in Stuart or Palm City. Contact us today to discuss your life insurance needs and secure your family's financial future in Stuart or Palm City, Martin

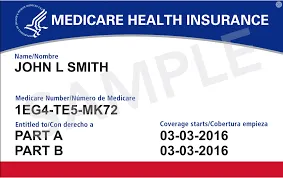

Medicare Advantage vs Supplement in Stuart or Palm City

Understanding the differences between Medicare Advantage VS Medicare Supplement plans is crucial when choosing your coverage. Medicare Advantage plans often bundle hospital, medical, and prescription drug coverage into one plan, while Medicare Supplement plans help cover costs not paid by Original Medicare. We help you compare the options to find the plan that best suits your needs and budget in Stuart or Palm City, US

Life Insurance

Life insurance is a foundational act of love—a way to provide financial security for your family when you can no longer be there for them. It ensures that your loved ones can cover expenses and maintain their way of life. We help individuals and families across Stuart or Palm City find an affordable policy that brings true peace of mind.

Protecting Your Family's Future

A life insurance policy provides a tax-free, cash payment to your chosen beneficiaries after your passing. This money can be used for anything they need, offering a financial safety net during a difficult time.

Cover Final Expenses & Burial Costs

Pay Off a Mortgage or Other Debts

Replace Lost Income for Your Family

Fund a Child's or Grandchild's Education

Leave a Financial Legacy or Charitable Gift

A Policy That Fits You Perfectly

There isn't a one-size-fits-all solution. Whether you need coverage for a specific period, like while raising a family, or a permanent policy that lasts your entire life, we can explain the options in simple terms.

Term Life: Affordable coverage for a specific number of years.

Whole Life: Lifelong protection that builds cash value.

Final Expense: Smaller policies to cover funeral costs.

We make it easy to understand the differences.

Find the right fit for your budget and goals.

Your Unbiased Local Guide - Finding the best rates

Life insurance rates can vary significantly between companies. As independent brokers, we are not tied to any single carrier. We shop the market for you, comparing dozens of top-rated companies to find you the most coverage at the best possible price.

Licensed & Trained Local Experts

We Compare All The Top-Rated Carriers

Personalized, Honest Advice

Support That Puts Your Family First

Our Guidance is Always Free

Lifelong Policy Support - A Partner for Life's Journey

Our relationship doesn't end when your policy is issued. We are here for the long haul to help you manage your policy, make updates as your life changes, and most importantly, to be a trusted resource for your family when the time comes to file a claim.

Annual Policy Reviews

Help with Beneficiary Updates

Guidance for Your Family During the Claims Process

Answering Your Questions, Any Time

A Trusted Partner You Can Count On

Services

We Specialize in:

STILL NOT SURE?

Frequently Asked Questions

1. How much life insurance do I actually need?

This is the most important question, and the answer is unique for everyone. A good starting point is to think about covering your major financial obligations: paying off your mortgage, clearing any debts (like car loans or credit cards), and replacing your income for a number of years so your family can maintain their lifestyle. We can sit down with you and help you calculate a comfortable and appropriate amount for your family's needs here in Stuart or Palm City.

2. What's the real difference between Term and Whole Life insurance?

The simplest way to think about it is like renting vs. owning. Term Life is like "renting" protection. It's very affordable and covers you for a specific period (the "term"), like 10, 20, or 30 years. It's perfect for covering needs that have an endpoint, like a mortgage or raising children. Whole Life is like "owning." It's a permanent policy that lasts your entire life, and it also builds cash value that you can borrow against over time.

3. Is life insurance expensive?

Most people are pleasantly surprised to find out that life insurance, especially Term Life, is much more affordable than they think. For a healthy young person, a significant amount of coverage can often be secured for less than the cost of a few cups of coffee each week. The final cost depends on a few key factors: your age, your health, the type of policy, and the amount of coverage you choose.

4. Do I have to take a medical exam to get life insurance?

Often, yes, but not always. For many policies, a simple, free medical exam (a nurse comes to your home) is required, and this typically gets you the most coverage for the lowest price. However, we understand that's not for everyone. There are now many excellent "no-exam" policy options available that use a health questionnaire instead. We can help you find the right type of policy for your comfort level.

Still Have Questions?

Our Medicare specialists in Stuart or Palm City are here to help with personalized guidance

LICENSED AND CERTIFIED

Florida Licensed Medicare Specialists

Community Focused

Dedicated to Stuart or Palm City seniors

5-Star Reviews

Trusted by local families

Martin

Serving all local communities

24 Hours by Appointment Only

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options

By providing your name and contact information you are consenting to receive calls, text messages and/or emails from a licensed sales agent about Medicare Plans at the number provided, and you agree such calls and/or text messages may use an auto-dialer or robocall, even if you are on a government do-not- call registry. This agreement is not a condition of enrollment. This is a solicitation of insurance. Your response may generate communication from a licensed insurance agent.