Medicare Part B in Stuart or Palm City

Medicare Part B: Medicare Part B covers medical services such as doctor visits, outpatient care, and preventive services. Understand the coverage provided by Medicare Part B and how it works with other parts of Medicare. Learn about the benefits and costs associated with Part B in Stuart or Palm City and make informed decisions about your healthcare coverage. Contact us for more information on Medicare Part B and how it applies to you in Stuart or Palm City, Martin

Medicare Advantage vs Supplement in Stuart or Palm City

Understanding the differences between Medicare Advantage VS Medicare Supplement plans is crucial when choosing your coverage. Medicare Advantage plans often bundle hospital, medical, and prescription drug coverage into one plan, while Medicare Supplement plans help cover costs not paid by Original Medicare. We help you compare the options to find the plan that best suits your needs and budget in Stuart or Palm City, US

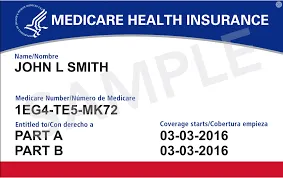

Medicare Part B

Medicare Part B is your medical insurance. It covers the essential day-to-day healthcare you receive outside of a hospital, like doctor visits and lab tests. Understanding your Part B costs and coverage is the foundation of building a secure healthcare plan. We're here to explain how it works for beneficiaries in Stuart or Palm City and how to best manage its costs.

Your Everyday Medical Coverage

Think of Part B as your primary health insurance for when you're not admitted to a hospital. It helps pay for the services and supplies that are medically necessary to treat your health condition. This includes regular check-ups, outpatient care, and preventative services to keep you healthy.

Doctor Visits & Specialist Appointments

Preventative Care (like flu shots & wellness visits)

Outpatient Hospital Care & Lab Tests

Durable Medical Equipment (walkers, oxygen, etc.)

Ambulance Services

Understanding your Part B Costs

Part B is not free. You will pay a standard monthly premium, which is often deducted directly from your Social Security. After you meet a small annual deductible, you are typically responsible for 20% of the cost for most services, with no yearly limit.

Freedom to Choose Your Doctors

Helps Cover Out-of-Pocket Costs

No Referrals Needed for Specialists

Coverage That Travels With You

Predictable Monthly Premiums

Medicare is your Network

Local Broker Assistance - Your Unbiased Local Guide

Instead of working for one insurance company, we work for you. As local brokers, our job is to understand your needs and compare all the top plans to find your best match.

Licensed & Trained Local Experts

We Compare All The Top Carriers

Personalized, Honest Advice

Support That Puts You First

Our Guidance is Always Free

Year-Round Support - A Partner in Your Health

Our commitment doesn't end when you enroll. We're here to help you all year long, whether you have questions about your coverage or need help with a plan change.

Annual Plan Reviews

Help with Claims & Appeals

Answering Your Questions

A Health Partner You Can Trust

Services

We Specialize in:

STILL NOT SURE?

Frequently Asked Questions

1. What does Medicare Part B cover?

Medicare Part B is your medical insurance. It covers the vast majority of your healthcare needs outside of a hospital stay. This includes essential services like doctor visits, specialist appointments, lab tests, X-rays, ambulance services, outpatient surgery, and durable medical equipment like walkers or oxygen. It also covers many preventative services to help keep you healthy.

2. How much does Medicare Part B cost?

You will pay a standard monthly premium for Part B, which is set by the government each year and is often deducted from your Social Security check. Most people pay this standard amount. However, if your income is above a certain level, you may pay a higher monthly premium. This is known as the Income-Related Monthly Adjustment Amount, or IRMAA.

3. What is the "20% co-insurance" I keep hearing about?

After you meet a small annual deductible, you are responsible for paying 20% of the Medicare-approved amount for most of your medical services. The critical thing to understand is that there is no yearly cap or limit on this 20%. A single expensive health issue could leave you with thousands of dollars in medical bills. This uncapped 20% is the primary reason why almost everyone gets additional insurance.

4. Is signing up for Part B optional?

Yes, but with a very important catch. You can delay enrolling in Part B if you have other "creditable" health coverage, such as from an employer where you are still actively working. If you don't have this other coverage and you don't sign up when you're first eligible, you could face a permanent Late Enrollment Penalty that will be added to your monthly premium for the rest of your life. We can help you navigate this decision in Stuart or Palm City to avoid any mistakes.

Still Have Questions?

Our Medicare specialists in Stuart or Palm City are here to help with personalized guidance

LICENSED AND CERTIFIED

Florida Licensed Medicare Specialists

Community Focused

Dedicated to Stuart or Palm City seniors

5-Star Reviews

Trusted by local families

Martin

Serving all local communities

24 Hours by Appointment Only

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options

By providing your name and contact information you are consenting to receive calls, text messages and/or emails from a licensed sales agent about Medicare Plans at the number provided, and you agree such calls and/or text messages may use an auto-dialer or robocall, even if you are on a government do-not- call registry. This agreement is not a condition of enrollment. This is a solicitation of insurance. Your response may generate communication from a licensed insurance agent.