Medicare Part C in Stuart or Palm City

Medicare Part C, also known as Medicare Advantage, offers all-in-one coverage through private insurance companies. These plans typically include benefits from Parts A and B, and may also include prescription drug coverage, offering a comprehensive approach to healthcare. When exploring Medicare Part C options, it's important to consider plans approved in Martin to find the best coverage for your needs. We can help you understand the options available and how they align with your healthcare needs, budget, and ensuring you make an informed decision in Stuart or Palm City, Martin

Medicare Advantage vs Supplement in Stuart or Palm City

Understanding the differences between Medicare Advantage VS Medicare Supplement plans is crucial when choosing your coverage. Medicare Advantage plans often bundle hospital, medical, and prescription drug coverage into one plan, while Medicare Supplement plans help cover costs not paid by Original Medicare. We help you compare the options to find the plan that best suits your needs and budget in Stuart or Palm City, US

Medicare Part C

Medicare Part C, more commonly known as Medicare Advantage, is an "all-in-one" plan choice that bundles all parts of Medicare together. These plans are offered by private insurance companies approved by Medicare and are a popular option for residents of Martin County. We can help you compare all the Part C plans in Stuart or Palm City to see if one is right for you.

How Part C Replaces Original Medicare

When you choose a Part C plan, you get your Part A (Hospital) and Part B (Medical) benefits directly from a private insurer. Most plans also include Part D (Prescription Drugs) and extra benefits like dental, vision, and hearing, all managed in one simple package.

Includes All Benefits of Part A & Part B

Most Plans Include Prescription Drug Coverage

Often Includes Dental, Vision & Hearing

Many Plans Available with a $0 Monthly Premium

Provides a Yearly Cap on Out-of-Pocket Costs

Things to Consider with Part C

Part C plans manage costs by using provider networks, like an HMO or PPO. This means you may need to use doctors and hospitals that are in the plan's network. It's crucial to check that your providers are included before you enroll, which is a service we provide for you.

Must Use Doctors in the Plan's Network

May Require Referrals to See Specialists

You Still Must Pay Your Part B Premium

Plan Costs and Benefits Can Change Annually

We Help You Review and Compare Plans Each Year

Local Broker Assistance - Your Unbiased Local Guide

Instead of working for one insurance company, we work for you. As local brokers, our job is to understand your needs and compare all the top plans to find your best match.

Licensed & Trained Local Experts

We Compare All The Top Carriers

Personalized, Honest Advice

Support That Puts You First

Our Guidance is Always Free

Year-Round Support - A Partner in Your Health

Our commitment doesn't end when you enroll. We're here to help you all year long, whether you have questions about your coverage or need help with a plan change.

Annual Plan Reviews

Help with Claims & Appeals

Answering Your Questions

A Health Partner You Can Trust

Services

We Specialize in:

STILL NOT SURE?

Frequently Asked Questions

1. What is Medicare Part C?

Medicare Part C is the official government term for a Medicare Advantage plan. It's an all-in-one plan option offered by private insurance companies that bundles your Part A (Hospital), Part B (Medical), and usually Part D (Prescription Drug) benefits into one single plan. Think of it as a different way to receive your Medicare benefits.

2. How does a Part C plan actually work?

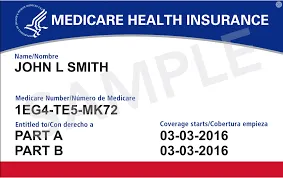

When you enroll in a Part C plan, the private insurance company takes over the administration of your Medicare benefits from the federal government. You'll use the insurance card from your Part C plan for all your healthcare services instead of your red, white, and blue Medicare card. The plan must provide all the same rights and protections as Original Medicare, and most offer extra benefits as well.

3. Are there different types of Part C plans?

Yes. The most common types you'll find in Stuart or Palm City are HMO and PPO plans. HMO (Health Maintenance Organization) plans generally require you to use doctors and hospitals within their network. PPO (Preferred Provider Organization) plans offer more flexibility to see out-of-network providers, though usually at a higher cost. Understanding this difference is key to choosing the right plan for you.

4. If I join a Medicare Part C plan, do I still need to pay my Part B premium?

Yes, this is a very important point. To be eligible for any Part C (Medicare Advantage) plan, you must be enrolled in Medicare Parts A and B. You must continue to pay your monthly Part B premium to the government to keep your coverage active. Any premium for your Part C plan (many of which are $0) is paid separately to the insurance company.

Still Have Questions?

Our Medicare specialists in Stuart or Palm City are here to help with personalized guidance

LICENSED AND CERTIFIED

Florida Licensed Medicare Specialists

Community Focused

Dedicated to Stuart or Palm City seniors

5-Star Reviews

Trusted by local families

Martin

Serving all local communities

24 Hours by Appointment Only

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options

By providing your name and contact information you are consenting to receive calls, text messages and/or emails from a licensed sales agent about Medicare Plans at the number provided, and you agree such calls and/or text messages may use an auto-dialer or robocall, even if you are on a government do-not- call registry. This agreement is not a condition of enrollment. This is a solicitation of insurance. Your response may generate communication from a licensed insurance agent.